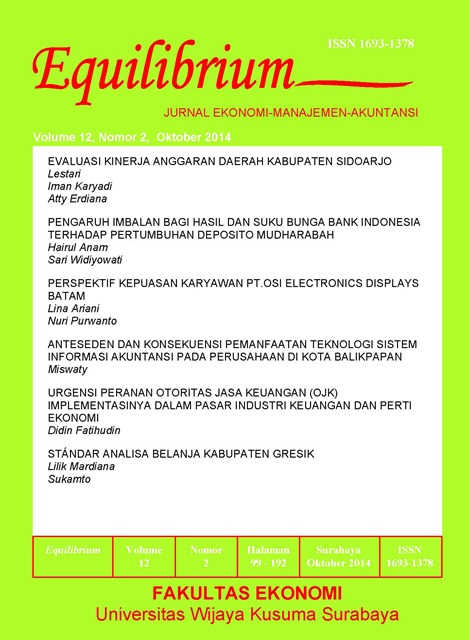

Pengaruh Imbalan Bagi Hasil dan Suku Bunga Bank Indonesia Terhadap Pertumbuhan Deposito Mudharabah

DOI:

https://doi.org/10.30742/equilibrium.v12i2.116Keywords:

Profit Sharing, Interest Rate (BI Rate), dan Mudharabah DepositsAbstract

The Influence of Profit Sharing and Interest Rates of Bank Indonesia on The Growth of Mudharabah Deposits; This study aimed to examine the effect of profit sharing and interest rates of Bank Indonesia on the growth of mudharabah deposits at PT. Bank Muamalat Indonesia, Tbk. The method used in this study was the quantitative research in methods of data collection techniques of documentation. Sample consists of 35 sample from the quarterly report of PT Bank Muamalat Indonesia, Tbk from January 2005 to September 2013. The method used is the multiple linear regression method. Based on this analysis of the obtained research results showed that profit sharing and interest rates of Bank Indonesia simultaneously influence significantly to growth of mudharabah deposits in Bank Muamalat Indonesia. This shows that information about profit sharing and interest rates of Bank Indonesia can be used to predict the growth of mudharabah deposits in Bank Muamalat Indonesia and collectively can make policy in investment decision making. And other results obtained that profit sharing and interest rates of Bank Indonesia partially positive and significant effect on the growth of deposits mudharabah in Bank Muamalat Indonesia. Results of this study are consistent with previous research indicated by Sutiani (2012) that profit sharing the positive effect of the nominal amount of the savings account holders in the Islamic bank. Because its customers are only willing to keep their funds in the bank that is willing and able to pay back these funds when billed. This proves that the majority of Indonesia's muslim community is still affected by the return will be accepted. The implications of this study are expected in management can improve the performance and management can work together with the Indonesian Ulema council to provide wider dissemination of the prohibition of bank interest is expected to enhance the bank's syariah.References

Anisah, Nur, Akhmad Riduan dan Lailatul Amanah .2013. Faktor-faktor yang mempengaruhi pertumbuhan deposito mudharabah bank syariah, jurnal Ilmu dan Riset Akuntansi, vol.1, No. 2

Antonio, Muhammad Syafi’i. 2001, Bank Syariah dari Teori Ke Praktek, Gema Insani : Jakarta.

------------------. 2004. Bank Syariah Analisis Kekuatan, Kelemahan, Peluang dan Ancaman. Ekonisia : Yogyakarta.

Arifin, Zainul. 2006. Dasar-Dasar Manajemen Bank Bank Syariah, Azkia Publisher : Jakarta.

Ascarya. 2008. Akad dan Produk Bank Syariah. PT. Rajagrafindo Persada : Jakarta

Trihendrad, C. 2010. Step By Step SPSS 18 Analisis Data Statistik, Andi : Yogyakarta.

Departemen Agama RI. 2007. Al-Quran dan Terjemahanya. CV Diponegoro : Jakarta.

Devita Purnamasari, Irma dan Suswinarno (eds). 2011. Akad Syariah. Cet. Ke-1. PT. Mizan : Bandung

Firdaus, Muhammad. 2005. Fatwa-Fatwa Ekonomi Syariah Kontemporer. Cet. Ke-1. Renaisan : Jakarta

Fitriah, Eliza dan Nur S. Buchori. 2011. Pengaruh Nisbah Bagi Hasil terhadap Penghimpunan Dana Bank Syariah (Studi Kasus Pada Produk Tabungan di BPR Syariah Kota Bekasi). Jurnal Maslahah, Volume 2 No 2 : 39-57.

Ghozali, Ahmad. 2005. Jangan Ada Dusta Diantara Kita – Serba-serbi Kredit Syariah. PT. Gramedia : Jakarta.

-------------------. 2006. Aplikasi Analisis Multivariate Dengan Program SPSS. Undip : Semarang

Haron, S. dan N. Ahmad. 2000. The Effect of Conventional Interest Rates and Rate of Profit on Funds Deposited With Islamic Banking System in Malaysia. International Journal of Islamic Financial Services, 1 : 1-4

Indriantoro, Nur, dan Bambang Supomo. 2009. Metodologi Penelitian Bisnis Untuk Akuntan dan Manajemen. BPFE : Yogyakarta

Karim, Adiwarman. 2004. Bank Islam Analisis Fiqih dan Keuangan. PT Raja Grafindo Persada : Jakarta.

-----------------. 2005. Islamic Banking Fiqh and Financial Analisis. PT Raja Grafindo Persada : Jakarta

-----------------. 2007. Bank Islam. PT. Raja Grafindo persada : Jakarta

Kasmir, 2002, Dasar-Dasar Perbankan, PT Raja Grafindo Persada : Jakarta.

-----------------. 2007. Bank dan Lembaga Keuangan Lainnya. Edisi Keenam, PT Raja Grafindo Persada : Jakarta

-----------------, 2010, Manajemen Perbankan, PT Raja Grafindo Persada : Jakarta.

Lipsey, Ragan, Courant. 1997. Market, Pricing, and Efficiency, Microeconomics

Muhamad. 2002. Bank Syariah (Analisis kekuatan, kelemahan, peluang dan ancaman). Ekonisia : Yogjakarta.

-----------------, 2004, Teknik Perhitungan Bagi Hasil dan Profit Margin pada Bank Syariah. Edisi Kedua, UII Press : Yogyakarta.

-----------------, 2005. Manajemen Bank Syariah. UPP AMPYKPN : Yogyakarta

Nejatullah Siddiqi, Muhammad. 1984. Bank Islam. Cet. Ke-1. Pustaka : Bandung.

Ridwan, Muhammad. 2004. Manajemen Baitul maal Wat Tamwil (BMT). UII Press : Yogyakarta

Rodoni, Ahmad. 2008. Lembaga Keuangan Syariah. Zikrul Hakim : Jakarta.

Saeed, Abdullah. 2003. Bank Islam dan Bunga – Studi Kritis Larangan Riba dan Interprestasi Kontemporer. Pustaka Pelajar Offset : Yogyakarta

Sarwoko. 2005. Dasar-Dasar Ekonometrika. Andi : Yogyakarta.

Sawaldjo, Puspopranoto. 2004. Keuangan Perbankan dan Pasar Keuangan. LP3ES : Jakarta

Siddiqi, Muhammad Nejatullah. 1984. Bank Islam. Cet. Ke-1 Pustaka : Bandung

Sudarsono, Heri. 2004. Bank dan Lembaga Keuangan Syariah. Ekonisia : Yogyakarta.

Sugiyono. 2011. Statistik Untuk Penelitian, Cet. Ke-18 Alfabeta : Bandung.

-----------------, 2014, Metode Penelitian Manajemen, Cetakan ke dua, Alfabet, Bandung

Suliyanto, 2011. Ekonometrika Terapan – Teori dan Aplikasi dengan SPSS. Andi : Yogyakarta.

Suprayitno, Eko. 2005. Ekonomi Islam. Graha Ilmu : Yogyakarta.

Sutiani, Herman Karamoy dan Winston Pontoh. 2012. Hubungan Imbalan Bagi Hasil, Pembiayaan, dan Suku Bunga Terhadap Jumlah Nominal Tabungan Nasabah Pada Bank Muamalat Manado Periode 2006-2010. Jurnal Riset Akuntansi dan Auditing Magister Akuntansi Fakultas Ekonomi Unsrat Goodwill, Volume 3 No 2 : 50-66.

UU RI Nomor 10 Tahun 1998 Tanggal 10 November 1998 tentang perbankan

Winarno, Sigit dan Sujana Ismaya. 2007. Kamus Besar Ekonomi. Pustaka Grafika : Bandung.

http://www.bi.go.id/web/en/Moneter/BI+Rate/Data+BI+Rate/

http://www.muamalatbank.com/home/investor/quarterly_report_new

Issue

Section

License

Authors who publish with this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Attribution-ShareAlike 4.0 International (CC BY-SA 4.0) License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work