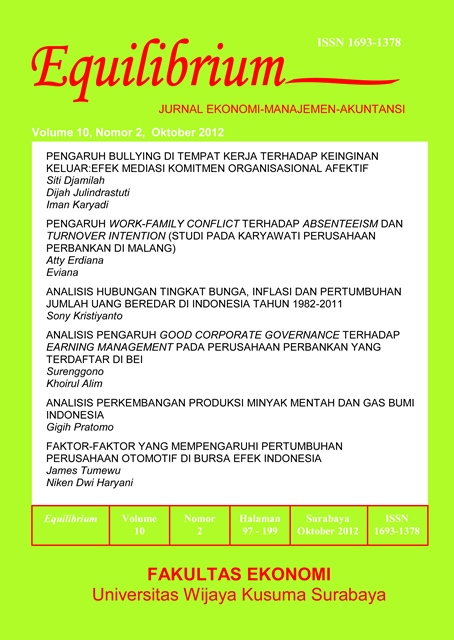

ANALISIS PENGARUH GOOD CORPORATE GOVERNANCE TERHADAP EARNING MANAGEMENT PADA PERUSAHAAN PERBANKAN YANG TERDAFTAR DI BEI

DOI:

https://doi.org/10.30742/equilibrium.v10i2.132Keywords:

the proportion of independent directors, audit committees, institutional ownership, managerial ownership, quality of audit, earning managementAbstract

Earning management is the moral hazard problems of the manager. Earning management occurs because there is a conflict of interest between the managers as agents and shareholders (principal) as owners of the company. Earning management will affect reported earnings. This study aims to determine the effect of good corporate governance in the form of the proportion of independent directors, audit committees, institutional ownership, managerial ownership, and the quality of audit on earning management. Sampling technique using purposive sampling with the following criteria: banking companies listed on the Indonesian Stock Exchange (BEI) since 2007 and is still listed as the issuer until the year 2009, published financial statements as of December 31, no merger, no acquisition and no restructuring during the study period (2007 – 2009). Based on these criteria, there are 15 companies that can be sampled. The results of hypothesis testing using multiple regression shows that good corporate governance in the form of the proportion of independent directors, audit committees, institutional ownership, managerial ownership, and audit quality do not significantly affect earnings management.References

Badan Pengawas Pasar Modal. 2004. Kep-29/PM/2004. Pembentukan dan Pedoman Kerja Komite Audit.

Bank Indonesia. 2006. Pelaksanaan Good Corporate GovernanceBagi Bank Umum. Peraturan Bank Indonesia No: 8/4/PBI/2006.

Bapepam. 2000. Pembentukan Komite Audit. Surat Edaran Bapepam No: SE.03/PM/2000.

Beasley, M. S. 1996. An Empirical Analysis of the Relation Between the Board of Director Composition and Financial Statement Fraud. The Accounting Review, 17(4): 443-465.

Beaver, W.H. & Engel, E.E. 1996. Discretionary behavior with respect to allowances for loan losses and the behavior of security prices. Journal of Accounting and Economics, 22: 177-206.

Beneish, M. D. 2001.Earnings management: aperspective. Managerial Finance, Vol. 27: 3-17.

Chtourou, S.M., J. Bedard&Courteau L. 2001. Corporate governance and Earning Management. Working Paper Universite Laval, Quebec City, Canada.

Fiedler, B., Arens, A., Best, P., Shailer, G. E.& Loebbecke, J. K. 2002. Auditing in Australia: An integrated approach.5th Edition.Australia: Pearson Education.

Gideon, S.B.2005. Kualitas Laba: Studi Pengaruh Mekanisme Corporate Governace dan Dampak Manajemen Laba dengan Menggunakan Analisis Jalur. Simposium Nasional Akuntansi VIII, IAI, 2005.

Gujarati, D. 2001. Ekonometrika Dasar. Terjemahan. Jakarta: Erlangga.

Hastuti, T. D. 2005. Hubungan antara good corporate governance dan struktur kepemilikan dengan kinerja keuangan. Simposium Nasional Akuntansi VII. Solo. Hal: 238-347

Healy, P.M. & Wahlen, J.M. 2000. A Review of the earning management literature and its implication for standard setting. Working Paper.

Jensen, M.C. & Meckling, W.H. 1973. Theory of the firm: managerial behavior, agency cost and ownership structure. Journal of Financial Economics, 3: 305-360

Mardjana, I K. 2000. Corporate governance dan privatisasi. Jurnal Reformasi Ekonomi,1 (2) Okt-Des.

Midiastuty, P. P. &Machfoedz, M. 2003. Analisis hubungan mekanisme corporate governance dan indikasi manajemen laba. Makalah Simposium NasionalAkuntansi VI.Surabaya. Hal: 176-199.

Nasution, M. &Setiawan, D. 2007. Pengaruh corporate governance terhadap manajemen laba di industri perbankan Indonesia. Makalah Simposium Nasional Akuntansi X. Makasar

Nikmah & Suranata, E. 2005. Hubungan kepemilikan institusional, earning management dan harga saham: suatu pendekatan dengan future earning. Jurnal Akunatansi, Bisnis dan Manajemen, 12 (2): 163-179.

Radita, K. 2006. Analisis pengaruh penerapan mekanisme good corporate governance(GCG) terhadap aktivitas manajemen laba perusahaan (studi terhadap perusahan manufaktur yang terdaftar di BEJ). Skripsi,Surabaya: Fakultas Ekonomi Universitas Airlangga.

Rahmawati & Baridwan, Z. 2006. Pengaruh asimetri informasi, regulasi perbankan, dan ukuran perusahaan pada manajemen laba dengan model akrual khusus perbankan.Jurnal Akuntansi dan Bisnis, 6(2): 139-150.

Scott, W.R. 2001. Financial Accounting Theory. New Jersey: Prentice Hall.

Ujiyantho, M. A.&Pramuka, B.A. 2007. Mekanismecorporate governance, manajemen laba dan kinerja keuangan.Makalah Simposium NAsional Akuntansi X. Makasar.

Utama, S.&Afriani, C. 2005. Corporate governance practice and value creation of companies: empirical studies in JSXâ€. Usahawan, No. 08 Year XXXIV August.

Veronica, N.P. & Bachtiar, Y.S. 2004. Good corporate governance, information asymmetry and earning management. Makalah Simposium Nasional Akuntansi VII. Denpasar. Hal:57-69.

Veronica, S. & Utama, S. 2005. Pengaruh struktur kepemilikan, ukuran peerusahaan, dan pratktek corporate governance terhadap pengelolaan laba (earning management). Simposium Nasional Akuntansi VIII. Solo.

Watts, R. L & Zimmerman, J.L. 2001. Possitive Accounting Theory. New Jersey: Prentice-Hall, Inc.

Wedari, L. K. 2004. Analisis pengaruh proporsi dewan komisaris dan keberdaan komite audit terhadap aktivitas manajemen laba. Makalah Simposium Nasional Akuntansi VII. Denpasar. Hal : 963-974.

Widyaningdyah, A. U. 2001. Analisis faktor-faktor yang berpengaruh terhadap earning management pada perusahaan go public di Indonesia. JurnalAkuntansi dan Keuangan. Vol. 3, No. 2, November. Hal: 89-101.

Wignjohatojo, P. 2001. Good corparate governance, Makalah disampaikan

pada Seminar Pengungkapan Informasi Keuangan pada Perusahaan-perusahaanPublik di Indonesia, diselenggarakan oleh FE Unair dan IAI Kompartemen Pendidik tanggai 18 Juni 2001.

Downloads

Issue

Section

License

Authors who publish with this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Attribution-ShareAlike 4.0 International (CC BY-SA 4.0) License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work