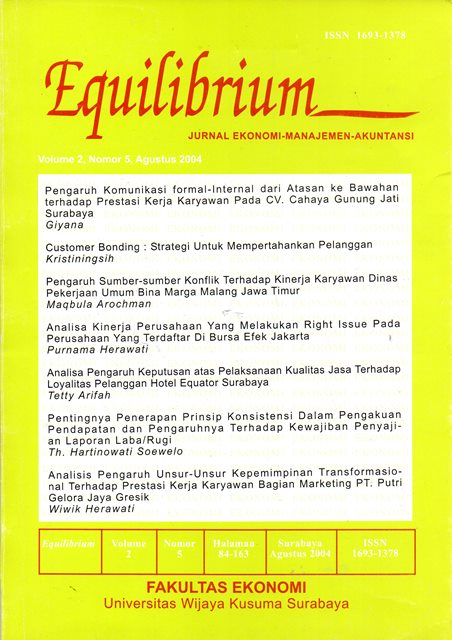

ANALISIS KINERJA PERUSAHAAN YANG MELAKUKAN RIGHT ISSUE PADA PERUSAHAAN YANG TERDAFTAR DI BURSA EFEK JAKARTA

DOI:

https://doi.org/10.30742/equilibrium.v2i5.187Keywords:

right issue, stock return, market returnAbstract

The event of right issue in emerging market has known as part of seasoned equity offering. There are many hypothesis state negative respone from investor as well as positive effect. The research want to test the financial and operating performance of campaign that conducting right issue (1997-1999), especially company performance in two years before and after that event. This study uses the sample of 62 firms listed in the Jakarta Stock Exchange. The hypothesis are tested applying paired t-test and independent sample t-test the analysis. The ratios such as current ratio, ATO, NPM, Tobin's Q, and PER, have statistically not significant results. These results mean that the profitability and operating performance of sample have decline after conducted right issues, while liquidity performance have shown increasing value. After comparing with non-issuers sample, the results of such as leverage, asset turnover, operating profit margin and Tobin's q of issuers. Have shown statistically significant in part periods, while other ratios like current ratio, net profit margin, and PER have shown statistically not significant results in all of periods. This study also test the impact of right issues on performance of the stock return, the result that companies have significant (before conducted right issue) of its stock return compare with non issuers and market return.References

Altman, E.I. 1986. Financial Ratios, Discreiminant Analysis and Prediction of Corporate Bankruptcy. The Journal of Finance, September.

Brigham, Eugene,L.C. Gapensky, dan P.R.Daves.1999. Intermediate Financial Management, Sixth Edition.The Dryden Press Hartcourt Brace College Publishers.

Budiarto, Arif, dan Zaki Baridwan.1999, Pengaruh pengumuman right issue terhadap tingkat keuntungan dan likuiditas saham di Bursa Efek Jakarta periode 1994-1996. Jurnal Riset Akuntansi Indonesia, vol.2 no.1.

Denis, David J. 1994. Investment opportunities ang the market reaction to equity offerings. Journal of Financial and Quantitative Analysis, Vol.29no.2.

Dhatt, M.S.,Kim,Y.H., dan Mukherji, S. 1996. Seasoned Equity Issues: The Korean experience. Pasific Basin Finance Journal 4, hal31-44.

Eckbo, B.E., Masulis, R.W. 1992. Adverse Selection and The Rights Offer Paradox. Journal offinancial Economics 32,293-332.

Emery, Douglas R dan John D.Finnerty,1997,Corporate Financial Management. New Jersey : Prentice Hall, Inc.

Fakhrudin, M. dan Hadianto, M.S.2001.Perangkat dan Model Analisis Investasi di Pasar Modal, Buku Satu. PT.Elex Media Komputindo,hal 66.

Hansen, R.S.,1989. The Demise of The Rights Issue.Review of Financial Studies 1, 289-3 09.

Harikumar, T. dan Harter, C.I. ,1992,Earnings Response Coefficient and Persistence: New Evidence Using Tobin's Q as A Proxy for Persistance.Journal of Accounting, Auditing & Finance.

Harto Puji, 2002, Analisis kinerja perusahaan yang melakukan right issue di Indonesia. Simposium Nasional Akuntansi 4.Indonesia:IAI,hal 307-322

Healey, Paul dan Khrisna G. Palepu.1990. Earnings and Risk Changes Surrounding Primary Stock Offer. Journal of Accounting Research. Vol.28, spring.

Jensen, Michael C. 1986. Agency Cost of Free Cash Flow, Corporate Finance, and Takeover.American Economic Review,76.

Kang, J., Stulz, R.1996. How Different is Japanese Corporate Finance? An Investigation of the Information Content of New Security Issues. Review of financial studies 9,109-139.

Korajczyk, R.A.,Lucas, D.J.,Mc Donald, R.L. 1992. Equity Issues with Time-varying Asymmetric Information. Journal of Financial and Quantitative Analysis 27, 397-418.

Loderer, C., Zimmermann, H.1988, Stock Offering in a Different Institutional Setting:The Swiss Case,1973-1983. Journal of Banking Finance 12, 353-378. Loghran, Tim dan Jay R. Ritter.1997. The Operating performance of Firms Conducting Seasoned Equity Offerings. Journal of Finance, vol.LlI, no.5, Desember 1997. Machfoedz, Mas'ud.1994. Finnancial Ratio Analysis and The Prediction of Earning Changes in Indonesia. Kelola, no.7.

__________,1999. Pengaruh Krisis Moneter pada efisiensi perusahaan publik di Bursa Efek Jakarta. Jurnal Ekonomi dan Bisnis Indonesia, vol. 14.

Marsden, Alastair.2000. Shareholder Wealth Effect of Rights Issues: Evidence from The New Zealand Capital Market. Pasifrc Basin Finance Journal, Vol.8.

Miller, M., dank. Rock.1985. Dividend Policy Under Asymmetric Information. Journal of Financial, p.1031-1051.

Myers, S.C., Majluf, N.S.1984. Corporate Financing and Investment Decicions when Firms Have Information that Investors do not Have.Journal of Financial economics 13,187-221

Ohlson, James A.1980. Financial Ratios and the Probabilistic Prediction of Bankruptcy. Journal of Accounting Research. Vol.18, Spring.

Ou, Jane dan S.H Penmann.1989.Financial Analysis and the Prediction of stock Return. Journal of Accounting and Economics,11.

Ross, Stephen A.,R.W. Westerfield, dan J.Jaffe.1998.Corporate Finance. Fourth edition. Irwin Mc-Graw Hill.

Thomson, James B. 1991. Predicting Bank Failure in the 1980s. Economic Review (First Quarter)

Tsangarakis, N.,1996. Shareholder Wealth Effects of Equity Issues in Emerging Markets: Evidence from Rights Offerings in Greece, Financial Management 25,21-32.

White, R.W., dan Lusztig, P.A.1980,The Price Effects of Rights Offerings. Journal of Financial and Quantitative Analysis 15,23-40.

Zainuddin, dan Jogiyanto Hartono.1999. Manfaat Rasio Keuangan Dalam Memprediksi Pertumbuhan Laba: Suatu Studi Empiris pada Perusahaan Perbankan yang Terdaftar di Bursa Efek Jakarta. Jurnal RisetAkuntansi, Vol 2, no.1

Downloads

Issue

Section

License

Authors who publish with this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Attribution-ShareAlike 4.0 International (CC BY-SA 4.0) License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work